It’s been on my

mind for quite some time now to perform a financial analysis of a company,

using available financial data and valuation models. I’ve always been looking

at charts, aka technical analysis, to

shape my investment views and it’s probably time I started analysing companies

based on more than just price movements.

So…What better way

to attempt some fundamental analysis than

on the second-largest listed company in Singapore, Singtel? Attempting analysis

on a company of this size may be biting off more than I can chew, but I shall

give it a try anyway.

Singtel is

Singapore’s largest telecommunications service provider, with a market capitalisation in excess of $60

billion, more than 10 times larger than its next biggest competitor, Starhub, at

$6 billion. Actually, most Singaporean readers will be sufficient

knowledgeable about this company and its two competitors and therefore I

shall not bore you with further elaboration.

However, not

everybody is aware that Singtel is actually a well-diversified telecom company,

owning 100% of Optus, the second-largest telecom company in Australia, as well

as having stakes in various telecom companies in the region, in places such as

Indonesia, Thailand, The Philippines and India. In fact, Singtel derives more than 70% of its earnings outside

of Singapore.

Recently, there

have been concerns that a fourth telco provider in Singapore could disrupt the oligopoly enjoyed by the current three

telcos in Singapore, sapping their market share which results in lower

revenues. Of the three, Singtel is widely-agreed to be the least affected,

having diversified itself

sufficiently. Therefore, should a fourth telco emerge, I do not expect Singtel’s

revenues to suffer drastically.

But before I

dive straight into the boring figures, let me pull up a chart of Singtel and

perform our favourite technical analysis.

Examining the

year-to-date (YTD) chart of Singtel, we see that the stock has been on an uptrend for much of the year. In late

June, prices managed to push above strong resistance at $4, which it retested in late July/early August, confirming the

former resistance has turned into support.

However,

following news of 3 telecom operators submitting their bids to become the

fourth telco in Singapore in early September, the stock tanked and plummeted

below the important $4 level. It also closed

below the trendline connecting the lows from the previous uptrend.

The next level

of support lies at $3.75, and below that, around

$3.65. However, with both the Relative Strength Index and StochasticOscillator currently registering drastically

oversold conditions, a drop downward to test those levels looks unlikely

without further catalysts.

In the short

term, Singtel looks very oversold and I suspect bargain hunters and traders

alike would take this opportunity to buy in, pushing prices higher next week. A

rebound to the critical $4 level

looks likely in the near term. Caution is advised for those trading for the

longer term as the 20 day SMA looks to be crossing below the 50 day SMA -- a bearish signal. With more impending

news regarding the fourth telco, expect more volatility in the weeks ahead.

Now, it’s time

for the numbers! I shall start off by listing some important figures and

valuation metrics, conveniently compiled into a table for you.

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

2011

|

|

16961

|

17223

|

16848

|

18183

|

18825

|

18071

|

|

|

5013

|

5091

|

5155

|

5200

|

5219

|

5119

|

|

|

3871

|

3782

|

3652

|

3508

|

3989

|

3825

|

|

|

EPS**

|

24.29

|

23.73

|

22.92

|

22.02

|

25.04

|

24.02

|

|

DPS**

|

17.5

|

17.5

|

16.8

|

16.8

|

15.8

|

15.8

|

|

NAV/share**

|

156.9

|

155.2

|

149.8

|

150.4

|

147.1

|

152.8

|

|

15.19%

|

15.6%

|

15.3%

|

14.8%

|

16.7%

|

16.0%

|

|

|

4.19%

|

9.3%

|

9.2%

|

8.7%

|

10.0%

|

9.9%

|

|

|

FCF*

|

2718

|

3549

|

3391

|

3759

|

3462

|

4038

|

*Figures in

millions of SGD

**Figures in

Singapore Cents

For those of you

unfamiliar with the acronyms/terms in the table, I’ve provided links to their

explanations. Of course, there are plenty more valuation metrics than the ones

I’ve listed, but I’ve decided to focus on the more important ones, and the ones

I’ve learned to use.

Just looking at

the figures alone, before performing any calculations, we can see than Singtel

is a stable company that generates consistent results year after year.

Revenue and net profit do not vary much, the company generates strong free cash flow year after year,

and dividends are increasing steadily. This is attributed to its size and

dominance in the marketplace.

Being a utility

stock, it lives up to the stereotype of generous dividends (Singtel aims for

70% payout ratio; It’s dividend yield is around 4%). However,

its 500-day rolling beta, a measure of

volatility, is currently 1.04 according to ShareInvestor,

which does not fit that stereotype (utility stocks are generally low-beta).

This could be due to Singtel being the largest constituent of the Straits Times

Index, hence movements in Singtel’s price affect movements in the index to a

greater extent than other constituents.

Before I

sidetrack too much, let’s get down to the business of valuation. I shall attempt

to value Singtel using 2 different models: the Dividend Discount Model and Free

Cash Flow to the Firm. It’s my first time performing analysis of such kind

and so do pardon and correct me if I’ve made any mistakes!

(For those who

are more averse to math, feel free to skip the calculations and jump to the

final number, which I will provide at the end of each section)

The Dividend Discount Model:

Also known as

the Gordon Model, after the professor

who invented it, the core concept here is that the value of the firm, and

therefore its stock, should be the present

value of all its future dividend payments to the investor. Therefore, this

involves discounting those future cash flows to the investor to their present

value today.

So, to find out

the fair value of Singtel stock based on this model, we simply plug in the

relevant numbers. Looking at dividend per share figure going back to 2011

(refer to table above), we see that Singtel is, on average, able to grow its dividends at approximately 5%

every two years, which I shall simplify to 2.5% per annum. We now have our figure

for g! No sweat so far huh?

The problem lies

in finding the appropriate discount/interest rate to apply. One of the books on value investing I’ve read advises using the Capital Asset Pricing Model (CAPM) to derive this rate:

r = rrf + β

(rm – rrf)

where r = appropriate

interest/discount rate

rrf =

risk-free rate, such as those on

Singapore government bonds

rm =

return on the market, or the returns of a broad based index

β = beta of the

security

Because

financial analysts always cannot agree on exactly what numbers to use for the

inputs, I’m going to use my own set of numbers, what I feel should be the value

for each term in the equation. For the risk-free rate, I’ll use 1.8%, the yield on 10-year Singapore Government Bonds. For return on the market, I’ll

use 8%, the approximate return on the StraitsTimes Index over the past 10 years, dividends reinvested. The beta of

Singtel is known, at 1.04.

Plonking all

these numbers into the equation generates a discount rate of 8.2%.

Phew!

Applying the

Dividend Discount Model, we arrive at a value of $3.15! That means, based on this model, the fair value

one should pay for a share of Singtel would be $3.15. At $3.87 as of the close

on Friday, 2 September, the current market price implies that Singtel is trading at a 23% premium to the modelled price. For value investors, there is NO

margin of safety, and therefore

Singtel does not make a sound investment at this price.

Free Cash Flow to the Firm:

This one is much

more tricky, and I don’t feel as confident in its execution, but I’ll give it a

go anyway. WARNING: Very long

calculations ahead! If you feel allergic to them please skip to the bottom of

the section where I’ll provide the final number, I promise!

First, if you’re

not familiar with the concept of Free Cash Flow, here’s a quick introduction to it. Since

Singtel provides free cash flow information on their investor relations webpage, I’ll simply use their numbers. If not,

I’ll proceed to define Free Cash Flow to the Firm (FCFF), since it’s not a

standardised accounting formula.

FCFF = Cash Flows from Operations + Interest Expense

(1 – Tax Rate) – Capital Expenditures

Therefore, the

market value of the firm using the FCFF model is:

However, to use

the simplified equation, one must first derive/estimate the FCFF for the

following year. The formula takes over by extrapolating from there on.

Oh

gosh, this part requires the most effort to piece together. The numbers

required for calculation are scattered everywhere! So dear reader please

appreciate what I’m doing for your ease of reading. Be glad you don’t have to

source for these numbers pouring through the 235 page annual report!

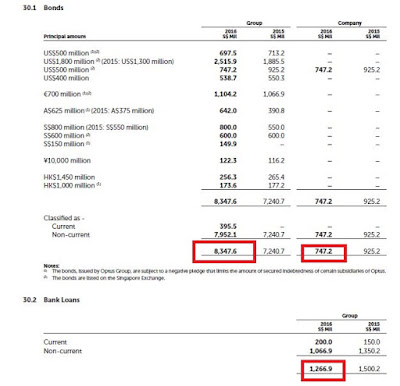

We see that

Singtel has a total of $9095 million in

outstanding issued bonds, with a weighted average effective interest rate of 3.8% for fixed rate bonds, and 1.7% for floating rate

bonds. Gah, for simplicity sake I’m going to assume the average effective

interest rate for ALL bonds outstanding is 3%. For bank borrowings, the figure is 2.3% for $1267 million

in debt. Total debt outstanding is $10362 million.

To minimise

headaches later on, I’m going to calculate the debt part of the WACC equation

first:

For bonds, after-tax

cost of debt, kd

= Before –tax cost

of debt x (1 – Tax Rate)

= 3% x (1 – 17%)

= 2.5%

For bank loans, kd

= 1.9%

Therefore,

Which works out

to 0.003, or 0.3%! WHAT! After all that hard work with the

calculations, just to arrive at this insignificant percentage!

For the cost of

equity, Ke , the formula is the same as the risk free rate,

which works out to 8.2%, as we calculated earlier on. By now, I think

even the math boffins would have given up working the equations and hence I’ll

just plug these numbers into the equation off-screen…

…arriving at a WACC

of 7.3%!

Now for the

final step! Scanning the FCF

values from the table above, we conclude that it has been fluctuating in a

range, between 3.4 to 4 billion. To estimate the

value of g required in the FCFF equation is going to be tricky.

I shall assume

a very pessimistic scenario of FCFF growing at just 2%

per annum. For the estimated FCFF for the following year, I shall use $3000 million, again pessimistic estimates given

rougher economic conditions expected. (Note: Singtel doesn’t’ generate interest

expenses but instead is more profitable after interest!)

Plug that into

equation and we arrive at a firm

value of $56.6 billion. With a current market cap of $61.7 billion, this

implies that Singtel shares are about 9% overvalued. Again, there is no margin of safety.

Conclusion:

Singtel, trading

at prices above the modelled values, provides no margin of safety for value investors and therefore is not an

ideal pick for a value investing candidate. However, being a stable and consistent performer as a

utility stock, it provides shareholders with solid dividend payouts and a slow share price appreciation over the

years. These factors probably explain why it trades at a premium and why many

analysts still have a “Buy” call on Singtel despite the stock being seemingly

overvalued.

Would I make an

investment in Singtel? Yes, but if only at the right price (I’m hoping for the

low end of $3, if that ever comes). A solid dividend provider, it can form the

bedrock of any yield/passive income portfolio.

No comments:

Post a Comment